More Evidence That Forbearance is Widely Being Taken as a Precaution

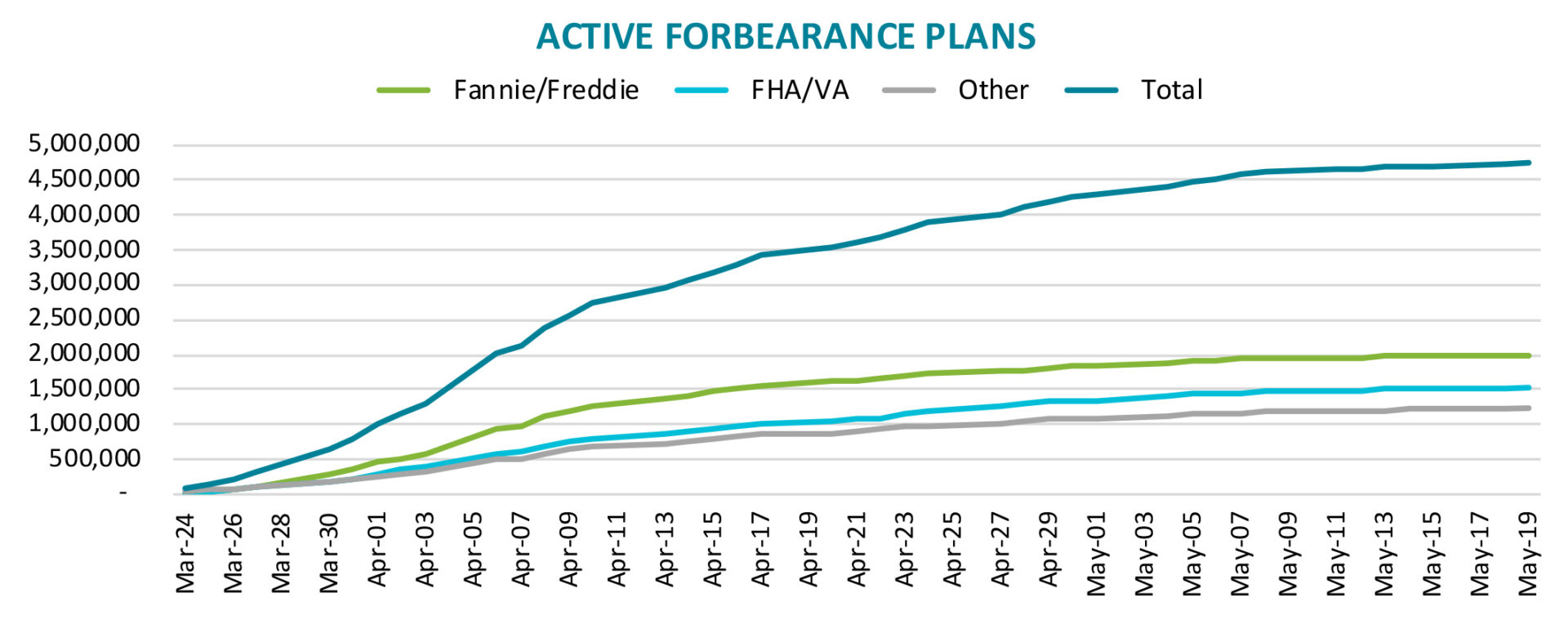

The number of homeowners in mortgage forbearance plans continues to increase, reaching 4.75 million by May 19. This is 9.0 percent of all active borrowers nationwide and represents a little more than $1 trillion in unpaid principal. The number of plans grew by 93,000 borrowers between May 12 and May 19.

Black Knight, in its weekly report on the forbearance program, offered to homeowners who have been financially impacted by the COVID-19 pandemic, notes that the most recent increase is down 70 percent from the 325,000 new plans during the first week of May, and is 93 percent lower than the 1.4 million plans opened the first week of April. This slowdown suggests that volumes may be beginning to flatten, warranting a shift in servicer focus from forbearance pipeline growth to forbearance pipeline management.

It appears that some homeowners may have, at least initially, requested a forbearance plan as a precaution. Black Knight says that about 46 percent of borrowers in forbearance at the end of April, 4.25 million in number, made that month's payment while 54 percent did not. Some made full payments, keeping the forbearance as a safety net in case the bottom drops out, while some made partial payments so as not build upon a growing amount that will ultimately need to be repaid.

This is somewhat in line with a Lending Tree survey of forborne homeowners reported here this week. Only 5 percent of those surveyed said they could not have made their mortgage payment without forbearance. Another 26.2 percent said they could have paid but would have needed to skip other essential bills.

But Black Knight says that May seems to be shaping up a bit differently. As of this report, only 21 percent of those in forbearance had made their May payments. This means that up to 1.4 million who made April payments are at risk of becoming past due in May. This could lead to another sharp increase in the national delinquency rate next month. While servicers are not allowed, under the CARES Act, to report forborne borrowers to the credit bureaus, Black Knight does include them in their monthly delinquency report and says the rate nearly doubled to 6.45 percent in March.

Of the 4.75 million loans currently in forbearance plans, those being serviced for the GSEs Fannie Mae and Freddie Mac account for 1.99 million with a principal balance of $419 billion. This is 7.1 percent of the GSEs' portfolios which total 27.9 million loans. Ginnie Mac loans (FHA, VA, and USDA) in plans total 1.53 million, 12.6 percent of its 12.1 million portfolio. The balance is $262 billion. The remaining 1.24 million loans in forbearance are being serviced for others - portfolio lenders, private label securitizations - and account for 9.5 percent of those 13.0 million loans with a balance of $363 billion.

Black Knight continues to track the obligation servicers have to make principal and interest (P&I) payments to investors and to pay property taxes and insurance premiums for borrowers with escrow accounts, even when mortgage payments are not being made. With the current number of forbearance plans it estimates that servicers of GSE loans are obligated to advance $2.2 billion monthly to investors and $900 million in T&I Ginnie Mae servicers must pay P&I advances of $1.4 billion and T&I of $600,000. Payments on other loans in service will be $2.1 billion and $700,000, respectively.

We will report on Black Knights assessment of loan delinquencies later on Friday.